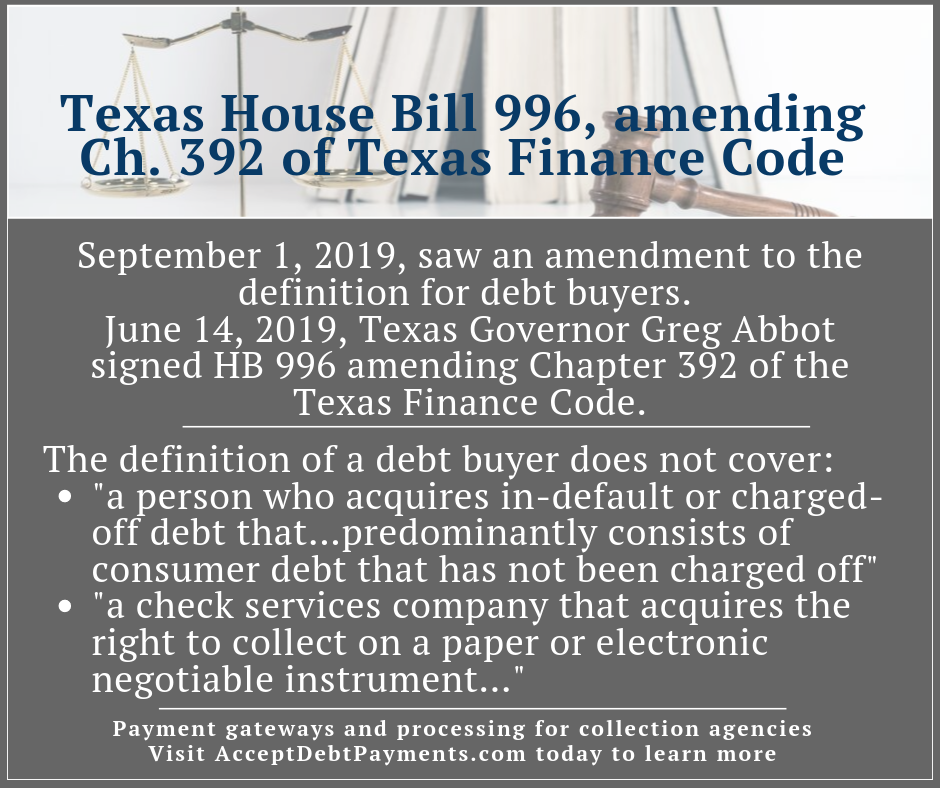

There are now some new changes to the debt collection requirements in Texas. On September 1, 2019, we saw an amendment to the requirements for debt buyers. This goes back to June 14, 2019, when Texas Governor Greg Abbot signed HB 996. This signing amends Chapter 392 of the Texas Finance Code, which deals with debt collection.

While it’s a State amendment, it begs the question of whether we’re about to see an influx of new requirements in other states when it comes to buying debt and third-party debt collection.

Consumer Finance Monitor reports that the bill “prohibits a debt buyer from commencing an action against or initiating arbitration with a consumer for the purpose of collecting a consumer debt after the statute of limitations has expired”.

What is a debt buyer?

As with any amendment, you can expect clear definitions of what the different terms refer to. In the case of the Chapter 392 amendment, a debt buyer refers to:

“a person who purchases or otherwise acquires a consumer debt from a creditor or other subsequent owner of the consumer debt, regardless of whether the person collects the consumer debt, hires a third party to collect the consumer debt, or hires an attorney to pursue collection litigation in connection with the consumer debt.”

However, this definition isn’t completely straightforward, as the Texas House Bill 996 specifically underlines that the definition does not cover:

“(A) a person who acquires in-default or charged-off debt that is incidental to the purchase of a portfolio that predominantly consists of consumer debt that has not been charged off; or

(B) a check services company that acquires the right to collect on a paper or electronic negotiable instrument, including an Automated Clearing House (ACH) authorization to debit an account that has not been processed.”

The first of the two excluded definitions deserves some additional attention. It refers to charged-off debt. We need to define “charged-off debt” in order to assess the significance of this. “Charged-off debt” means a consumer debt that a creditor has determined to be a loss or expense to the creditor instead of an asset.

What can we take away from this amendment?

A far as we can deduce, the terms ‘debt buyers’ and ‘third-party debt collectors’ only technically apply to the acquisition and/or collection of debts that are still in effect and are not written off as a loss by the original debt holders.

In other words, you can’t start initiating arbitration or attempting actions to collect on debts that are past their statute of limitations.

Furthermore, a payment or oral or written affirmation of the consumer debt does not revive the debt. If the debt is to be revived, the debt buyer or third-party debt collector needs to provide a specified notice in the initial written communication with the consumer.

Clearly, this adds to the complexity of collecting on debts past their statute of limitations. It will be interesting to see how this shapes up and whether this demonstrates a new shift in debt collection practices.

Please note

We are not attorneys and cannot provide legal advice. This article is not a legal opinion. You should consult a qualified attorney with any pertinent questions.

Further debt collection industry updates

For more information related to this specific amendment, please see:

Related collection industry news:

- TCPA debt collection exception held unconstitutional by the Ninth Circuit

- Consumer Financial Protection Bureau proposes new regulations: The Fair Debt Collection Practices Act

Need assistance taking debt collector credit card payments?

AcceptDebtPayments.com is a website dedicated to assisting debt collection companies both large and small with effective, simple to manage credit card processing. We offer payment gateway services that work with your collection agency’s existing software platforms – along with simple “pay your bill here” buttons that can easily be added to nearly any existing site. You can read more about what we do here.